The (online) marketing world is a place where we love ourselves some acronyms. Think of words like PPC, USP, CPA, CPC, CRO, CTA, and ROI.

Do you know what they all mean?

(hint Pay-Per-Click, Unique Selling Point, Cost-per-Action, Cost-per-Click, Conversion Rate Optimisation, Call-To-Action, Return-On-Investment).

In this article, we will talk about getting new customers and the value they bring to your organization when they are your customers.

After all, getting new customers takes a lot of work.

You have to take your time for them to get to know you and your product or service. Get to know you to such a rate that they fall in love with you and start buying your product or service.

In every business niche, there are always competitors to be found. Advertising costs are rising, implementing a good content marketing strategy for long-term SEO success takes time and money, and even specific acquisition campaigns you’ve started might not return customers quickly enough.

So how can you increase the likelihood of your business having enough capital and having enough runway to keep in existence?

Table of Contents

- What is Customer Lifetime Value

- Why is Customer Lifetime Value so important?

- What Variables You Need to Calculate Your Customer Lifetime Value

- Average Monthly Revenue per Customer

- Gross Margin per Customer

- Monthly Churn Rate

- Segmenting the result

- How to improve your Customer Lifetime Value

- How to improve your Customer Lifetime Value

You do this by increasing the lifetime value of your customers.

When you look at the value a customer brings to your organization, it is tempting to only look at the here and now. Someone who clicks on one of your ads buys your product or service, and there is a specific ROI you can calculate as a result.

When someone converts, you’ve achieved your goal, and money is in the bank.

But that is only a one-off set of money coming in. What about the lifetime value of that customer? What could that customer be worth over a longer duration of the relationship that she or he is having with your brand?

When you start to understand your Customer Lifetime Value (CLV), you will see the evidence that it is much easier and cheaper to sell to an existing client than it is to acquire a new one.

Growing your business can be as easy as creating customers with the highest loyalty and lifetime value.

Why?

Because you can skip all the first steps into the Buyers Journey.

Instead of you having to run awareness ads, use lead magnets, hiring a staff to do sales calls, you can merely upset the people you’re already having.

So in this post, we will dive into CLV, what it is, how you can calculate yours, and how you can improve your relationship with your most profitable customers so you can focus on them and grow your business.

What is Customer Lifetime Value

Customer Lifetime Value (also known as CLTV, LCV, or LTV) is a metric often misunderstood and, even worse, entirely overlooked by most companies.

In marketing, Customer Lifetime Value is the value of a given customer and his or her contribution to your business. In other words, Customer lifetime value is how much a single customer spends with you before leaving and never returning. And as a result, it is typically defined as the value (in dollars, euros, or whatever your local currency is) of the net profit you can expect from him or her.

CLV isn’t just about the next conversion, email signup, or social share. It forces you to look at the relationship with your audience as a long-term strategy. When you’re focused on CLV, you’re focused on building a loyal audience and catering to their needs.

Knowing this number will help you get a completely different outlook on how much you should be willing to invest in acquisition costs to get a new customer.

For example, let’s say a customer’s CLV is $80K. If you need to spend around $15K per year to service this customer and acquiring a customer like this costs you $20K, how long do you want to keep this customer? Of course, you don’t want to keep them for more than four years; otherwise, you will break even and start to lose money.

As you can see as soon as you start to understand these numbers for your company, it can help your business be much more profitable and bring focus to your marketing and sales teams to help identify which customers to focus on.

Why is Customer Lifetime Value so important?

Customer Lifetime Value is crucial, that much you probably figured out by now. But let’s look at a couple of different reasons why it is so important.

#1 It can be a benchmark for your company’s worth

The first reason looks to the future. If you know how many customers you have and how much (on average) they spend for you as an owner, you can quickly figure out how much your business is worth. Knowing how much your business is worth is a significant metric to use when talking to investors or a bank when you’re looking to get some extra money to grow and expand your business.

Or even when, at one point, there are talks about someone wanting to buy your company. Knowing how much your is worth is a key metric in these negotiations.

#2 It helps you shift priorities

Because CLV shows you the significance of repeat business, it can help you put your priorities straight. CLV helps you to focus on growing your existing customer base and selling more to them.

It is a bit in line with the “1000 true fans” concept coined by Kevin Kelly in 2008. His model focuses on getting 1000 fans for your business and driving many sales through these loyal customers.

Why is this important?

As you can already see earlier, not all customers are created equal. And getting new customers is five times as expensive as keeping an existing one.

These two reasons show why for everyone in the sales and marketing department. Even more, every entrepreneur and business owner should use this metric as a critical component in their entire business strategy.

Knowing your CLV will help you answer three fundamental questions:

- Are you paying enough to acquire customers from each marketing channel?

- Are you acquiring the best kind of customers?

- How much can you spend on keeping them sweet with email, social media, or other ways of delighting your customers?

Answering these questions will help you focus and grow your business.

What Variables You Need to Calculate Your Customer Lifetime Value

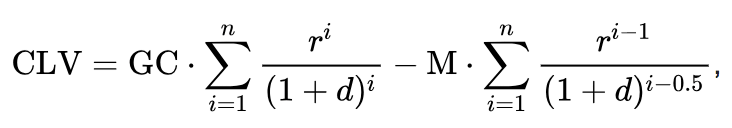

Now you are fully aware of the importance of CLV, now let’s figure out what your Customer’s Lifetime Value is. The best way to calculate CLV, according to Wikipedia, can look a bit complex:

Where it takes into account churn rate, discount rate, contribution margin, retention cost, and the period for which to calculate the customer relationship for analysis (the most commonly used period is a year).

However, we can understand that this looks a bit too complicated to let’s look at a way to calculate CLV.

(Avg Monthly Revenue per Customer * Gross Margin per Customer) ÷ Monthly Churn Rate

So the first parts show you the average monthly profit per customer (the revenue times the gross margin), and you divide that by the churn rate (or the chance that the customer will still be around in future months).

For example: $200 avg monthly spend * 30% margin ÷ 6% monthly churn = $1000 LTV

Let’s have a look at the individual components that make up the formula:

Average Monthly Revenue per Customer

The average monthly revenue is an easy one. By looking at your database for a more extended period (let’s say two years), you can see how much each customer spends on average every month in your store. Let’s say they buy with you seven times per year for a total of $60. Then the average monthly revenue per customer is $35.

Gross Margin per Customer

How much margin do you create on each sale you’re making? Let’s say you buy your product for $45 but sell it for $60. Then your gross margin per customer is 33%.

Monthly Churn Rate

The last part of the equation is the monthly churn rate. And it is probably one of the hardest things to measure accurately. This one shows the percentage of people that decide to end the relationship with your company each month. In other words, someone keeps on coming back to your company, buying from you, and at one point, they become dormant and abandon you forever.

However, this part depends on the niche your e-commerce business operates in. For instance, Starbucks reports that its average customer lifespan is 20 years.

Using your customers’ average lifespan helps you calculate how many of them you are going away every month and are never returning anymore.

Segmenting the result

When looking at the average CLV of your business, the problem is that they might hide all sorts of exciting stuff that is happening underneath the surface.

So, now that you know your CLV for all of your clients, it is worthwhile to start zooming in on the bigger picture.

Maybe you can try and segment your customer base over a more extended period, as Avinash suggests. Let’s look at a period of perhaps two years or the total amount of money spent to see interesting patterns there.

You might see things like the fact that your most valuable customers last year bought five times more than the average. The spend was 45% more than the average per order. Those hidden gems make up the last 20% of your customer base.

And where are those most valuable customers coming from?

By looking at where you acquired your unprofitable, profitable, and very profitable customers, you can determine which marketing channels you need to double down on. A simple segmentation by channel can help you find these answers as well.

As you can see, there is always more information to get discovered if you just take the time to look at your data.

How to improve your Customer Lifetime Value

The next step is all about using the information you have right now. The Customer Lifetime Value of your customers, what channels they are coming from, how they interact with your brand etc., to delight them and improve your CLV.

So what’s next?

Let’s look at four key steps to maximizing your CLV:

- The first is to combine all your customer interactions in one database. Having all your interactions with your customers centralized will give you even greater insights into how and why specific customers are doing particular things. If you can only do one thing to improve your learning, this step would be it;

- The second thing would be to create a model of the entire customer lifecycle, the customer journey. From the moment they hear about you for the first time till the moment they churn. This sounds complicated, but it shouldn’t be that difficult if you’ve done the first step. If you want to make the most out of this step, link all the cross-channel behavior with the purchase history details. Bonus points if you do this in real-time;

- The third thing would be to look at the data and the information from the previous steps and start understanding where your customers are in their lifecycle with you. How they are interacting with your brand and then using that information to engage with them when and where it creates the most effective contact points;

- The last step would be identifying the key drivers that bring lifetime value. A lot of small businesses and marketers are still struggling to connect the Return-On-Investment (ROI) to a campaign that doesn’t give a direct response.

But when you have all the information centrally in one database for your customers, you can start to attribute the revenue that comes from investments in social media, email marketing, banners, etc. you can identify the different segments, as mentioned earlier, that are the key drivers of lifetime value, of bringing your customers into that last 20% of very profitable customers and of course double down on those specific drivers.

How to improve your Customer Lifetime Value

Once you turn your company into a continuous learning organization and you’ve got your strategies in place to increase the Customer Lifetime Value of your company, it is time to identify the tactics to implement these strategies.

How will you turn the strategies you developed into actionable items for your business?

If you want to start increasing your CLV, many different options are available to you. All of these options begin by improving the customer experience, taking care of your customers, and making sure they turn loyal to you.

To help you get started, we’ve listed five ways to start with your company.

#1 Communication

Probably the most important one of them all. If you want to increase your sales with your customers and build a higher CLV, you must stay on top of mind with your customers. And the best way to keep it on top of mind is to communicate regularly.

If you want to build a relationship with someone and create a powerful brand with excellent brand loyalty and advocates, you need to communicate with them. Consistently delivering on your brand promise, meeting the expectations set for your customers, and interacting with them builds brand trust.

Communicating with your customers can be done in lots of different ways. It can be done using email marketing, chatbots, or voice, but whatever channel you choose, make it one-to-one. Send unique campaigns for their birthdays or anniversaries as a client with special discounts.

Other ways to communicate with your customers are by showcasing their success stories on your social media channels, doing a user-generated content contest, and showcasing the best cases. This can work as (free) advertisement for them, and it helps build relationships with your customers.

Another hot topic around communication, of course, is customer service. Having excellent customer service will do your CLV wonders. Be sure that there are plenty of options to contact you in case of a customer service question. Again, email, chat, voice (phone), and social.

When there is an issue, people want it solved as quickly as possible and didn’t have to start searching for the correct way to contact you, so be ready and be available at all times. In a 24/7 connected world, shutting your customer service down “after business hours” is not how to satisfy your customers.

#2 Personalisation

When you gather so much data about your customers, they take it for granted that you do something with this information.

With access to all that data, personalization becomes so much more than sending an email with “Hey [Firstname].” Your customers start to expect personalized product offers, personalized promotions, and everything else that can be personalized to their person or their customer segment.

By using dynamic content on your website and in your marketing messages, they can always see the most relevant offers to them. For example, you can create a complete personalized homepage highlighting products that interest them. But also showing related products as soon as they view an item or add a specific item to their online shopping carts.

Send out individual emails giving discounts or highlighting products that could be of interest (Amazon does a fantastic job with their Kindle book section, emailing me daily with potentially relevant books).

Don’t forget to make it extremely easy for your customers to make repeat purchases from your company as well by offering an easy username and password retrieval or by saving customer data like shipping and payment details so the next time, they don’t have to type everything from scratch again.

The easier you make the purchase process, the more it will increase sales.

And things like this are great ways to increase sales with every order and get more orders in, to begin with.

#3 Exclusive offers and programs

Suppose you want (and can) take personalization even one step further. In that case, you can start recognizing and rewarding customers by making exclusive offers and plans available to them, especially for your most loyal customers.

Frequent flyer miles are a great example of this, but any other frequent shopper program will do.

What kind of loyalty perks can you introduce in your organization to make your customers feel more special?

#4 The devil is in the details

People love getting surprised as much as the next one. Zappos made their fortune around surprise and delight. Even though people have bought something from you at a particular date and time and keep on coming back to you, you should never cut any corners. Always try to go that extra mile.

Going back to Zappos, they would often offer free overnight delivery. When you put the items in the box towards your customers, don’t just throw them in the box. Maybe include a little note to ensure that the presentation the customers see when they open the box is entirely in line with your brand reputation and promise.

Dutch online retailer Coolblue even goes as far as to make their boxes something special, putting instructions on them to make little houses for your animal at home and having a specially dedicated website showing all sorts of creations people are making with their boxes.

What are you doing to bring that smile to your customer’s faces when the delivery person drops off your package?

#5 Re-engaging sleeping customers

We started by talking about communicating. But what do you do to re-engage those customers that haven’t opened any of your communication in a while? Or maybe they did not purchase already for some time as well?

If you don’t try to re-engage them, they will never move up the cycle and turn into repeat customers. Maybe you can try to re-engage them with email marketing, offering them a coupon or something else that is special to them to come back and start buying again. Or maybe use old-school direct marketing, send a postcard to their home, showing everything they are missing out on (assuming you stored their home address), and inviting them back. You can’t go creative enough with stuff like this. What about a vacation card telling you how much you miss them and can’t wait to see them again when you come back home?

Don’t forget that re-engagement is also for those customers who abandoned their shopping carts—using retargeting ads for people who started a specific customer journey or visited a particular page on your website but didn’t buy or convert.

These last two are great for increasing sales from new and prior customers. Remind them what they miss out on when they don’t buy from you.

So there you have it, the one metric to rule them all. Getting new customers (especially for a new brand) has become increasingly complex and expensive. Potential competitors are fighting for the same attention as your target audience everywhere you look.

Some tactics like SEO, Content Marketing and PPC are expensive and don’t always guarantee results from the get-go.

But you still need customers to help grow your business.

All the tactics mentioned above will help you maximize the Customer’s Lifetime Value and secure long-term business growth.

Instead of getting hundreds of thousands of new customers, you need to start creating customers with higher lifetime value.

When you start to pay attention to the different elements that make up the CLV and begin implementing segments to get an even better picture, you should be able to adjust your marketing strategy so that it aligns with what will serve your customers best.

Only then will customers start coming back again and again?

Not all customers are created equal. Be sure you’re reaching and engaging those who will drive your business forward for long-term success.

What successful strategies have you used to increase your customer lifetime value? Leave a comment below so we can all learn from it and grow our businesses.